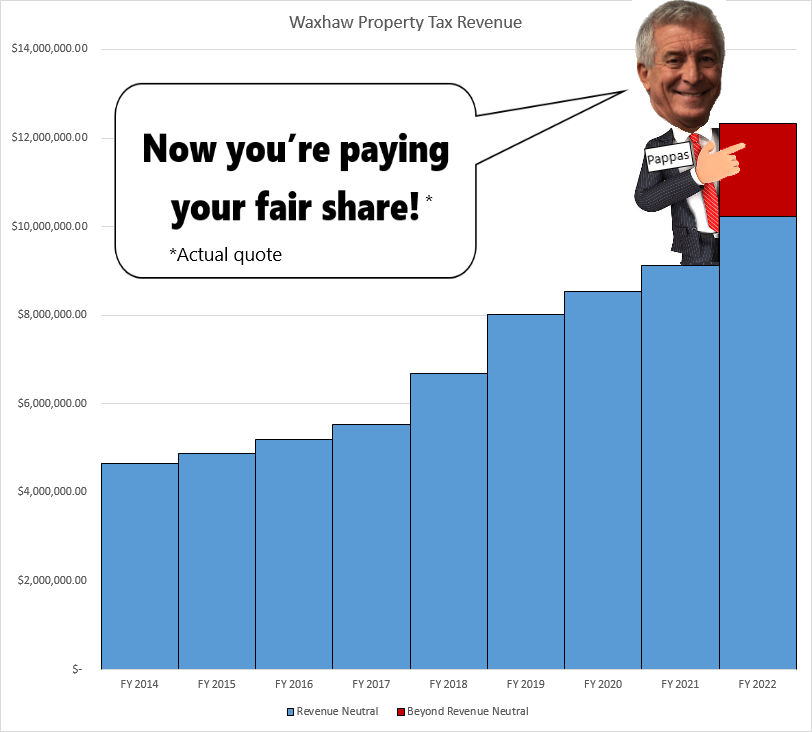

On July 22nd, 2021, the BOC voted for a budget which did not compensate for the enormous rise in property values post-revaluation. The revenue neutral rate of 32 cents for every $100 of value was ignored. By maintaining the rate of 38.5 cents, property tax revenues subsequently shot up by about 20%.

To justify this, it was claimed that the town was in bad financial shape. However, the 2021 audit seems to tell another story (page 7):

As of the close of the current fiscal year, the Town’s governmental funds reported combined ending fund balances of $21,238,655, an increase of $5,265,485 or 33% increase from the prior year fund balance. The increase is primarily due to revenues exceeding expenditures for the current year.

Waxhaw 2021 Audit

So far, the hike’s annual addition of approximately $2M to the town revenues has been mostly consumed by the $1.7M yearly payment to service the dept that the town took on to pay for the new town campus.